Introduction

In India, more than 33.44 lakhs cases are registered only of cheque bounce, and over 38 lakh cases are pending in the country.

So we can say that cheque bounce cases have become very common these days. In this article, we will read about how to file a cheque bounce case in India, the costs involved, and basically, we will cover everything related to cheque bounce in India.

How to file a cheque bounce case in India?

Cheque bounce is a criminal offence in India, covered under section 138 of the Negotiable Instruments Act. This article will act as a guide on what steps can be undertaken in case your cheque is bounced.

Keep reading to know more about how to deal with cheque bounce cases in India?

Send the person a demand notice

Once the cheque has been returned to you by the bank, you can now proceed to file a complaint against the drawer within a period of 30 days from the date the cheque has been returned to you by the bank. You will have to send a demand letter/ legal notice to the drawer.

The letter must demand the amount from the drawer and also the legal action that can be initiated against him under the Negotiable Instruments Act in case the accused fails to repay the amount in the stipulated time. (usually 15 days).

The purpose of this notice is to inform the drawer that you are demanding your payment and that you will take legal action if the payment is not returned in the stipulated time.

A demand letter can be sent by the complainant himself/herself but it is advisable to take the help of a lawyer who can draft a legal notice for you with all the legal knowledge put into it.

The following information should be stated clearly in the demand notice

- A statement that the cheque was presented within its period of validity.

- Demanding the issuer to pay the amount due within 15 days of receiving such notice.

- Statement of debt or legally enforceable liability.

- Information regarding dishonour of cheque as given by the bank.

Draft a complaint against the drawer of the cheque

If the drawer has not replied to your demand notice within 15 days after the notice has been delivered or if he/she has refused to pay your amount then the next option you have is to file a complaint in the court within a time period of 30 days.

Before filing a legal complaint, it is important to understand which court you should approach in such cases. You can file the complaint in a court within whose local limits of jurisdiction any of the following incidents have taken place

- Where the cheque was drawn

- Where the cheque was presented

- Where the cheque was returned by the bank

- Where the demand notice was served by you

The documents you will need are as follows:

- Your complaint

- Oath letter

- Photocopy of all the documents such as cheque memo, notice copy, and acknowledgement receipts

The court will summon the accused

After the court has acknowledged the complaint, the court issue summons to the accused person who owes the money to the person who filed the complaint. After the summon is sent the drawer has to be present on the date of hearing.

Pieces of evidence will be presented in the court

Your lawyers will present all the evidence before the court which proves your part.

Evidence like the original bounced cheque, cheque return memo, a record of sending a demand notice to the accused, and all other relevant documents in support of his/her case will be presented before the court.

The punishment and the penalties will be decided by the court

After the whole trial process, If found guilty, the accused can be punished with a monetary penalty which may be double the amount of the cheque or imprisonment up to 2 years or both.

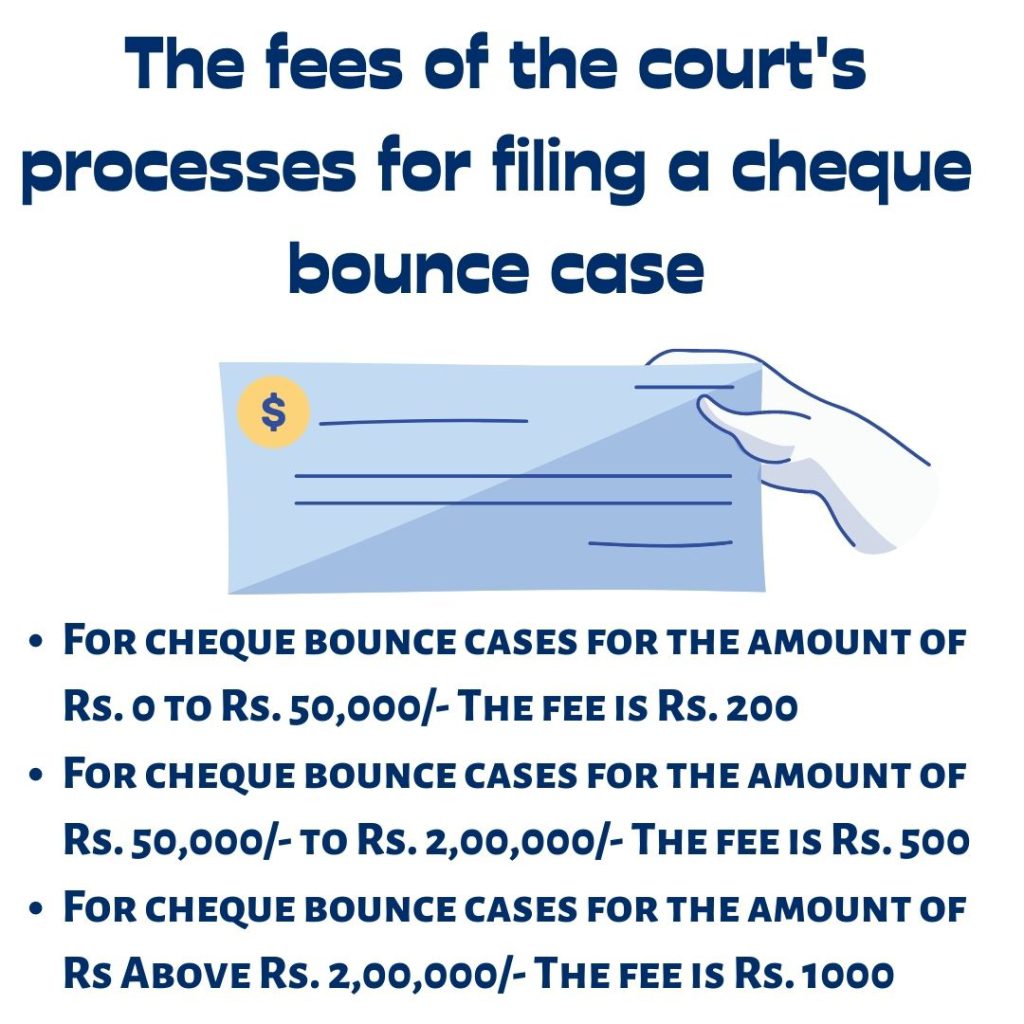

The fees of the court’s processes for filing a cheque bounce case

While filing a cheque bounce complaint, the complainant is required to pay court fees. The Court fees vary depending upon the amount of the cheque against which the complaint is being filed. The required court fees for various cheque amounts have been listed below.

Amount of court fee for filing the cheque bounce case

- For cheque bounce cases for the amount of Rs. 0 to Rs. 50,000/- The fee is Rs. 200

- For cheque bounce cases for the amount of Rs. 50,000/- to Rs. 2,00,000/- The fee is Rs. 500

- For cheque bounce cases for the amount of Rs Above Rs. 2,00,000/- The fee is Rs. 1000

A memo of the advocate is essential at the time of filing the suit along with the signatures of the complainant

A memo of appearance filed by the advocate is essential at the time of filing the suit along with the signatures of the complainant.

- After the case is filed in the court, all documents are cross-checked by a first-class Judicial Magistrate, so original documents such as original cheque (bounced), original memo, a copy of the notice, receipt of the post office, receipt of U.P.C., acknowledgement receipt, are required at the time of cross-checking.

- The period of limitation is also verified at this stage.

- The Process Form is filed by the complainant or lawyer, along with the address of the accused drawer.

- The court then issues summons to the accused to appear in the court on a specific date.

- If the accused does not appear in court on the date of hearing, the court can also issue a bailable warrant of arrest at the request of the complainant.

- If the accused still does not appear before the court, the court may issue a non-bailable warrant of arrest.

Important things to keep in mind

Here are a few things that you need to keep in mind before filing or during the proceedings of the cheque bounce case.

- Make sure the demand notice is sent to the drawer before 30 days after the bank has returned the cheque. A delay in filing the complaint after the lapse of 30 days may be excused by the magistrate only in exceptional circumstances.

- Keep in mind that a cheque expires after three months from the date on which it is issued.

- A cheque issued as a gift/donation/any other obligation, will not be covered under Section 138 of the Act. For this section to apply, the cheque has to carry a legal obligation.

- Dishonour of a cheque due to stop payment is also covered under Section 138 of the negotiable instruments Act.

- Presentation of the cheque at the request of the drawer after the demand notice has been sent and the consequent dishonour of the cheque will not mean that the drawer’s time limit under the notice has increased.

Hire a good lawyer

It is very much advisable to hire a lawyer for your cheque bounce case. Their legal knowledge can help you strengthen your case and get out of all the trouble which you are facing. If you wish to consult a good cheque bounce lawyer, do visit us at our website. We are there to help you.

Conclusion

As per the statistics, cheque bounce cases are common these days, So it’s very important that we are well versed with the consequences and the solutions if in case it happens to us.

So with that note, I hope that this article would have helped you in some or the other way. Do share it with your friends and family and let’s raise awareness.