Introduction

In India, more than 33.44 lakhs cases are registered only of cheque bounce, and over 38 lakh cases are pending in the country.

So we can say that cheque bounce cases have become very common these days. In this article, we are going to read about what to do if the cheque bounces and basically we will cover everything related to cheque bounce cases.

Keep Reading!

Suggested Reading: How to file a cheque bounce case in India?

What does a bounced cheque mean?

A cheque is said to be bounced if the payee presents a cheque to the bank for payment and the cheque is returned unpaid by the bank with a memo of insufficient funds. In India cheque bounce or dishonoring of the cheque is considered a criminal offence under section 138 of the Negotiable Instruments Act 1881. The punishment for this is a fine of double the amount of the cheque bounced or imprisonment for two years or both.

A cheque can bounce due to several reasons which we will discuss in the section below.

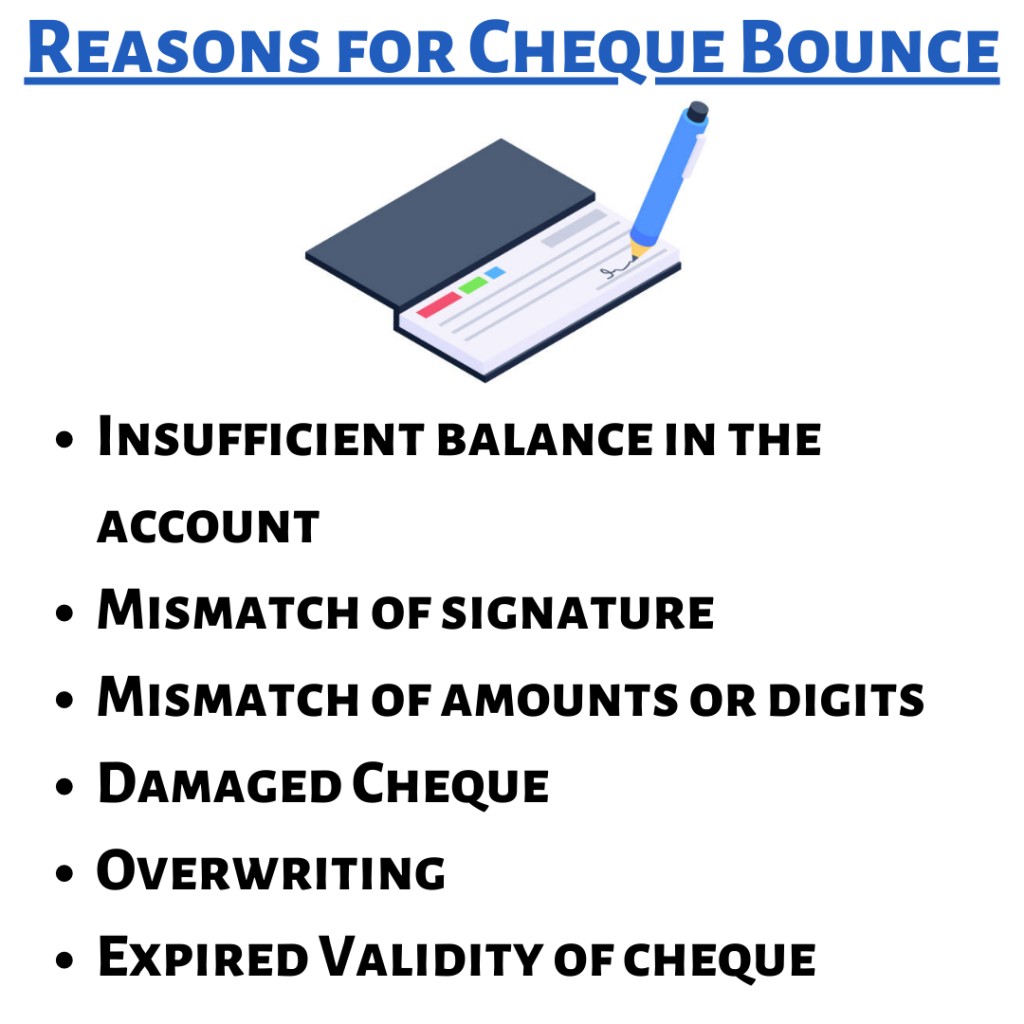

Reasons for cheque bounce

There could be many reasons for cheque bounce which we are going to discuss one by one in detail.

- Insufficient balance in the account

When the account of the drawer does not have enough balance to make the payment of the cheque, the cheque is said to be bounced due to insufficient balance in the account. In this case, the bank will reject and return the cheque to the payee stating the reason and giving the memo stating an insufficient balance to pay the cheque amounts.

- Mismatch of signature

This is also one of the common reasons for a cheque bounce. This happens when the signature of the drawer does not match the signature available in the bank’s data or the signature is absent or unclear.

- Mismatch of amounts or digits

When we write a cheque, the amount is specified in words and in numbers. So when there is a mismatch between these two, the cheque bounces. It is important to regard the signature as a prominent aspect while writing a cheque. Also, if the issuer by chance signs on the MICR Band present on the cheque, then in this situation the bank would once again disrepute the cheque.

- Damaged Cheque

If the cheque is damaged or disfigured such that the important details are not visible or the cheque has marks or stains, then in this case the cheque will bounce.

- Overwriting

If on the cheque the important details like the date, the signature of the drawer, and the amount, are overwritten then it is very much possible that your cheque will bounce.

- Expired Validity of cheque

When the drawer issues the cheque, a specific date is specified on it, The cheque has to be presented in the bank for payment within the three months of the date specified. If it is presented after the expiry date i.e after three months of the specified date then the cheque will bounce.

What to do if the cheque bounces?

Now the question comes of what to do if the cheque bounces?

So there are two scenarios here, number 1 is if the cheque presented by you to the payee has bounced (You’re the drawer) and number 2 the cheque presented to you by the drawer has bounced (You’re the payee).

So both the situations will be explained in the sections below.

Resubmission of cheque

So if as a drawer the cheque presented by you has bounced due to a mismatch of signature, date, and other important details, here is what you are supposed to do.

In this case, mostly the payee will ask to resubmit the cheque to rectify the mistake. If the drawer agrees to resubmit the cheque, it’s well and good if not then the payee can initiate legal actions against the drawee to pay the cheque amount due to him and not the cheque bounce.

Cheque bounce notice under section 138 of the negotiable Instruments Act

A cheque bounce notice comes under section 138 of the Negotiable Instruments Act when a cheque bounces due to insufficient funds in the drawers’ account to make the cheque amount payment. The cheque bounce notice cannot be served if the cheque has bounced for any reason other than insufficient funds in the bank account of the drawer. In such cases, the payee can demand resubmission of the cheque to get the due payment.

Issuance of cheque bounce notice

So when a cheque bounces due to an insufficient amount, the first step is to demand the payment of the amount given on the cheque by issuing a cheque bounce notice by writing a post under the negotiable instruments Act. The payee can issue the notice within thirty days of the intimation sent by the bank and the bounced cheque stating that the bank cannot make the payment due to the insufficient balance present in the account of the drawer.

After issuing the notice the payee must wait up to 15 days time period from the receipt of the cheque bounce notice for the drawer to make the cheque amount. If the drawer doesn’t initiate the action to reimburse the amount, the payee then can initiate suitable legal action against him.

However, there is a condition, A cheque bounce notice cannot be issued if the cheque has been presented as a gift, a donation, or any other event that is not legally enforceable.

Procedure to follow after issuance of a cheque bounce notice

After 15 days of issuing a cheque bounce notice, after the expiry date, the payee can initiate legal action against the drawer. The payee can register a complaint under section 138 of the Negotiable Instrument Act.

A cheque bounce case is a criminal offence that has a punishment of up to two years of imprisonment and a fine double the amount of a cheque issued or both. The payee must file the complaint against the cheque bounce before the Magistrate within 30 days of the expiry of 15 days of issuing the cheque bounce notice.

Jurisdiction of the magistrate for filing cheque bounce suit

A very important part of any legal case is the jurisdiction i.e where the case will get filed. So here are the places where a payee can file a complaint before the magistrate.

- Where the cheque was drawn

- Where the cheque was presented for the payment

- Where the cheque is dishonored

- Where the demand notice has been served

- Where the payment has to be made.

Process of cheque bounce suit

The Process of a cheque bounce suit is as follows.

- The first step is to file a complaint before the magistrate after the expiry of 15 days period of the demand notice by the drawer

- Then the payee/complainant has to appear before the honorable court to provide all the details of the case. If the magistrate gets satisfied with the complainant’s statement, he will issue a summon against the drawer for appearing before the court.

- The drawer will then appear before the court, he can accept or deny the allegations made against him. If the drawer refuses the complaint, the court will proceed with the case’s criminal trial.

- After this step, the drawer will file his reply to the complaint in the court, and he will record the statement before the court. the arguments and the evidence will be presented by both sides in the court.

- After the arguments based on the evidence presented in the court, if the drawer is found guilty then the court will pass a judgment of conviction against the drawer for the offence of cheque bounce.

Punishment for a cheque bounce case

- The punishment for the cheque bounce includes imprisonment for two years or a fine of double the amount presented on the cheque or both.

- A civil suit can also be instituted against the drawer to pay the cheque amount. In the case of an institution of the civil suit, the payee cannot send the demand notice to the drawer, he can only send the legal notice for the recovery of the amount.

- The offence of cheque bounce under section 138 of the act provides criminal punishment for the cheque bounce due to an insufficient amount. In contrast, a civil suit for recovery does not punish the drawer and only attempts the recovery of the cheque bounce amount.

- A criminal suit can be filed against a company against section 148 of the act if the cheque presented by the company has bounced due to an insufficient amount in the bank. When a criminal suit is initiated under section 148 of the act, then the company and its directors will be punished for cheque bounces.

- However, if the drawer pays the cheque amount to the payee within 15 days after receiving the demand notice, then no one can initiate the legal proceedings against the drawer and no offence is created by him under section 138 of the Negotiable Instrument Act.

How to respond to a cheque bounce case

If you have received a legal notice for a cheque bounce case, the first step is to reply to the notice in your defence. It is advisable to consult a good cheque bounce lawyer before initiating any reply to the legal notice. If you want to resolve the matter then and there it is better that you must pay the amount within the stipulated time period. If the cheque amount is paid at the starting stage, there will be no legal proceedings further.

New cheque bounce rules

According to a notice issued by The Reserve Bank Of India in early august of 2021, the customers who deal with amounts through cheques on the daily basis or those who have a plan to do so will have to maintain a minimum balance. If this minimum balance is not maintained the cheque will bounce. Also, the customer who has issued the cheque may also have to pay a penalty fee. Along with these changes, the Reserve Bank Of India announced that the National Automated Clearing House (NACH) would be operational 24 hours a day.

These changes are applied to all national and private banks. The change in the rule was brought to make the process smoother and faster.

Since the new rule ensures that NACH will be operational on all days of the week, Sunday will also be a day on which the entity can process and clear a cheque.

Cheque bounce Penalty by Popular Banks

| Serial No. | Bank | Charges |

| 1 | SBI | Cheque/bill deposited with SBI returned unpaid by others (Local/ Outstation)Cheque/bill up to ₹1.00 lacs – ₹150/- + GST Cheque/bill above ₹1.00 lacs – ₹250/- + GST Cheque Returned Charges for Cheques drawn on SBI (for insufficient funds only) (for all segments) ₹500/- + GST (irrespective of the amount) Cheque returned charges for Cheques drawn on SBI (for technical reasons) for all segments when the customer is at fault. ₹150/- + GST |

| 2 | HDFC | Savings A/c Outward: ₹100/- Inward: First cheque return in a quarter – ₹350/-. From second cheque return in the same quarter – ₹750/- per return Current A/c Outward: ₹50/- Inward: ₹300/- Dishonor of Outstation Cheques Regular Savings Outward: ₹100/- Inward: ₹350/- Senior Citizen Account Outward: ₹80/- Inward: ₹350/- |

| 3 | ICICI | Local ChargesCheque deposited by the customer – ₹100/- (for every cheque returned for financial reasons) Cheque issued by the customer –₹350/- (for one cheque return per month); ₹750/- per return in the same month for financial reasons. ₹50/- for non-financial reasons except for signature verification for every cheque return for financial reasons. Outstation Charges Outstation cheque deposited by the customer – ₹150/- + other bank charges at actuals per cheque. |

| 4 | AXIS | Return of cheques deposited at the home branch for local clearing – ₹500/- per cheque |

| 5 | BANK OF BARODA | Cheque (deposited by BOB’s customer and returned unpaid (Inward Return) Up to ₹1 lac – ₹125/- Above ₹1 lac to less than ₹1 crore – ₹250/- Above ₹1 crore – ₹500/- Cheque (drawn on BOB) returned (Outward Return)– (Financial Reason) Up to 1 lac – ₹250/- Above ₹1 lac to less than ₹1 crore – ₹500/- For ₹1 crore and above – ₹750 per instrument In case the bank remains out of funds; actual interest @ 7.5% over the base rate is to be charged extra For other reasons – ₹250/- |

Conclusion

I hope that this article would have of some help to you. If you have any queries regarding cheque bounce cases visit our website for a consultation.